Waikele Stats

If we look at the 2-bedroom townhome market in Waikele, over the past two years, closing volume in 2024 is down 29% of what is was in 2023. 2023 is down 18% of what is was in 2022. Clearly a visible market slow down with rising interest rates. Fortunately rates have come down 1.5% in the past 12 months.

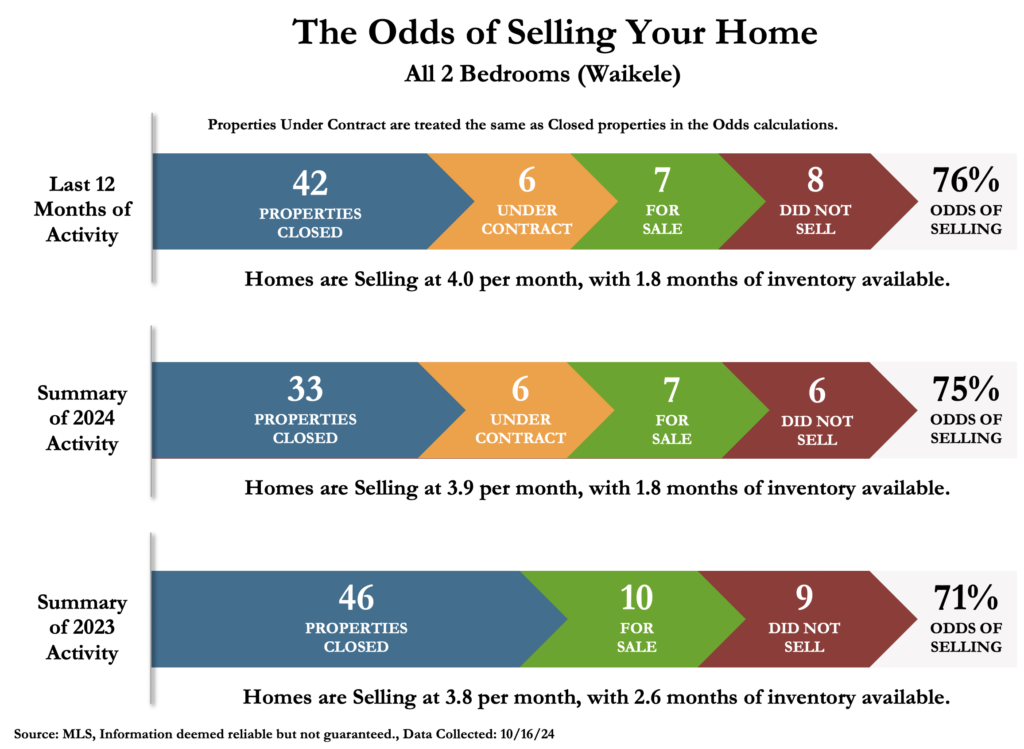

These charts represent all 2-bedroom townhome closings in Waikele over the past 2 years. In the Odds of Selling Chart, we can see that in 2023, 46 properties sold (blue), 10 properties were still “for sale” at year’s end (green) and 9 units “did not sell” (red). Units were selling at a rate of 3.8/month and there was 2.6 months supply of inventory (pretty low). Given these numbers, you had a 71% odds of selling in 2023.

So far in 2024, 33 townhomes closed (~71% of the previous year), 6 units are currently in escrow (orange), 7 units are currently active on the market (green) and 6 units “did not sell” (red). The units are roughly selling at 3.9/month (about the same pace as 2023) and there is 1.8 months of inventory on the market (down 21% – very low supply). Odds of selling are off 75% (up 4%).

6 months of supply is considered a balanced market and less than 6 months is considered a seller’s market. In summary, over the past two years, we see a continued slow down in sale’s volume, an overall decrease in supply, unchanged selling rate and an increase in odds of selling.

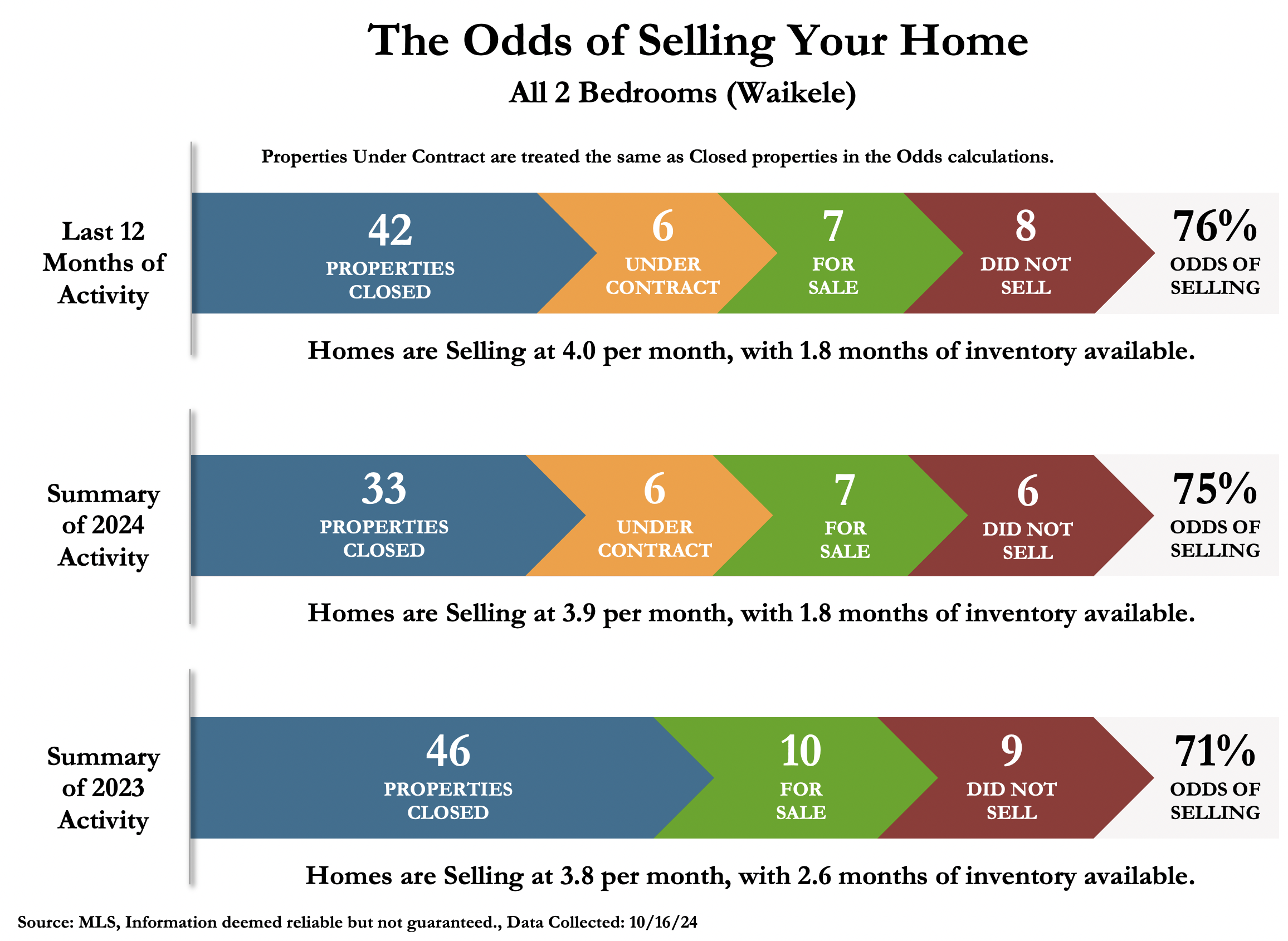

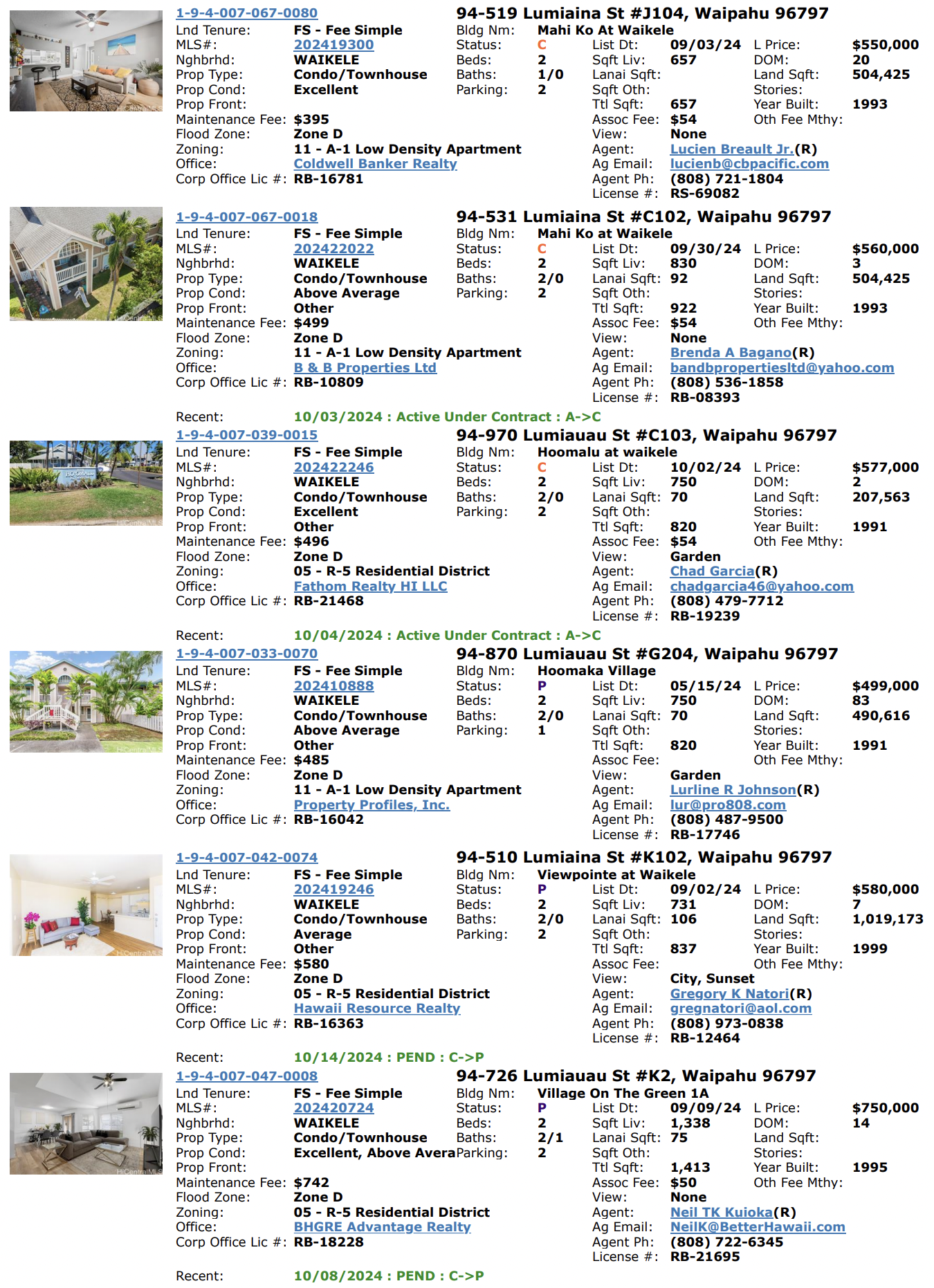

These are the 7 active listings on the market.

Three recent closings: We priced our Wilhelmina listing at $1,288M and it was bid up to $1.35M. Mariners Village 3, priced at $670k and bid up to $700k. Naniwa Gardens, we priced at $630k and were bid up to $675k. It is much better to be under market and get bid up, than to sit on the market and reduce price and waste time. We have two current listings in Waikiki, where we started our prices too high and reduced price through out the year. They have been on the market since last Christmas. We ended up adding new kitchens, last month, in each unit and reducing price again. Finally we are getting a lot of activity on those. AlohaLani.net

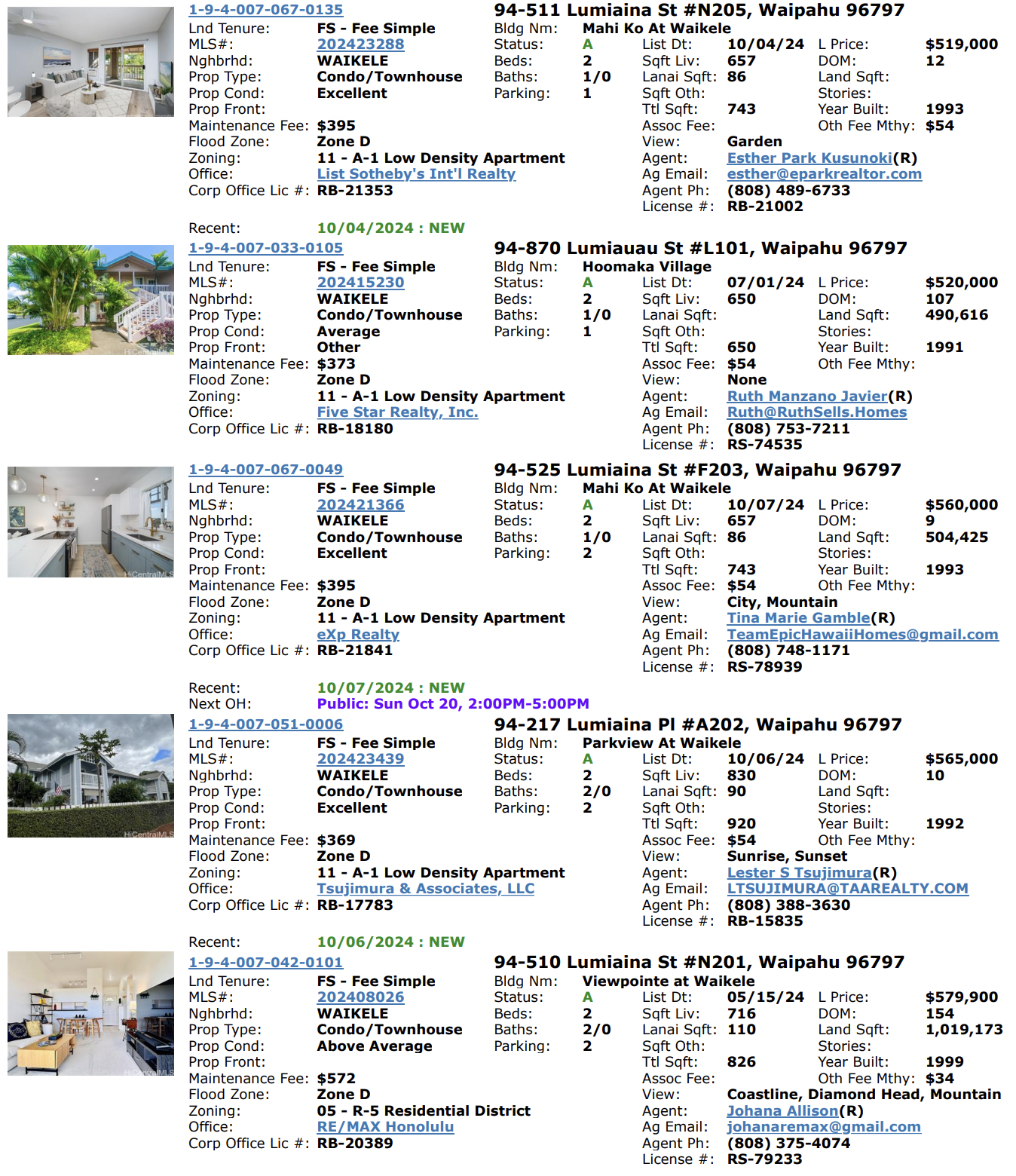

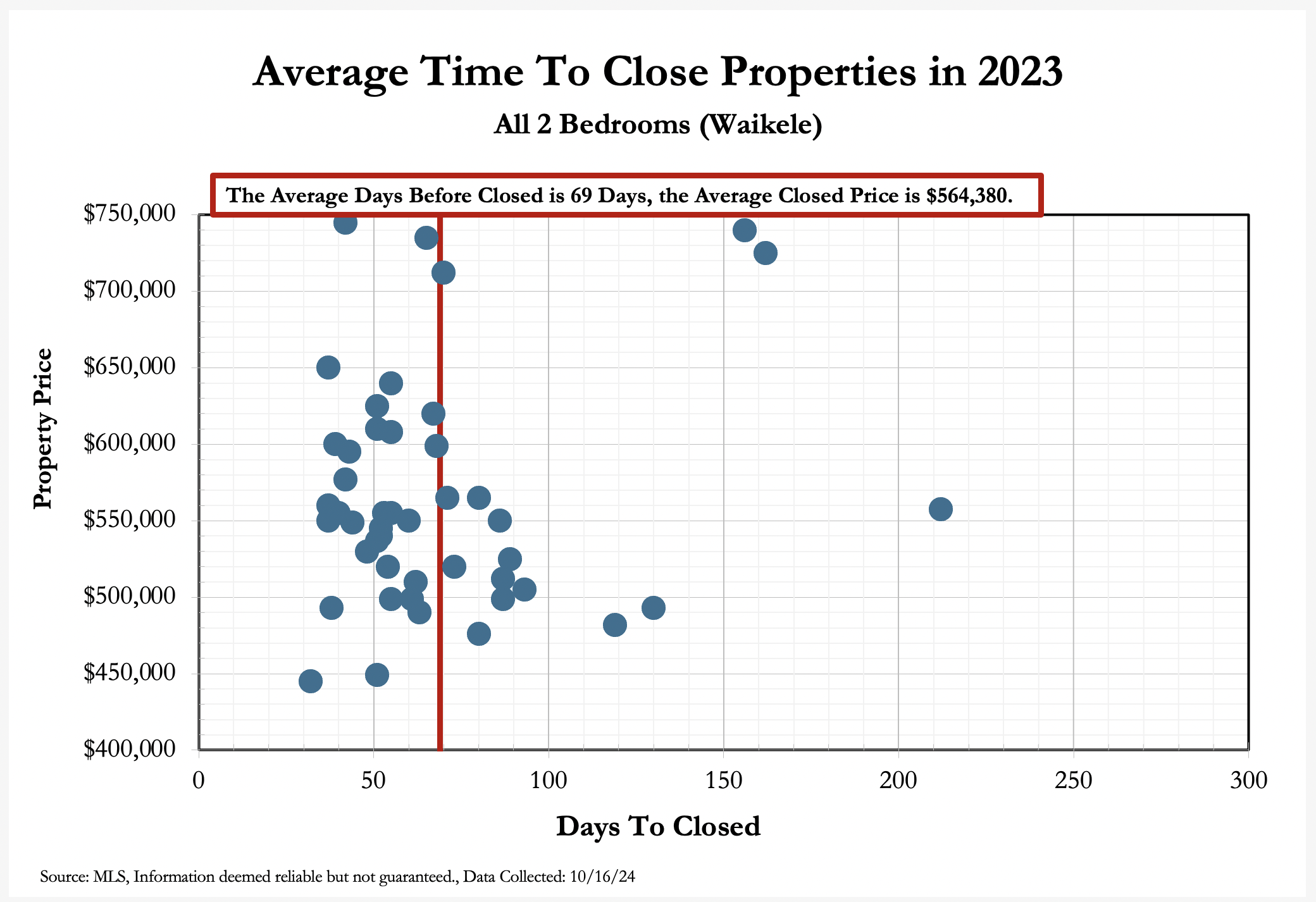

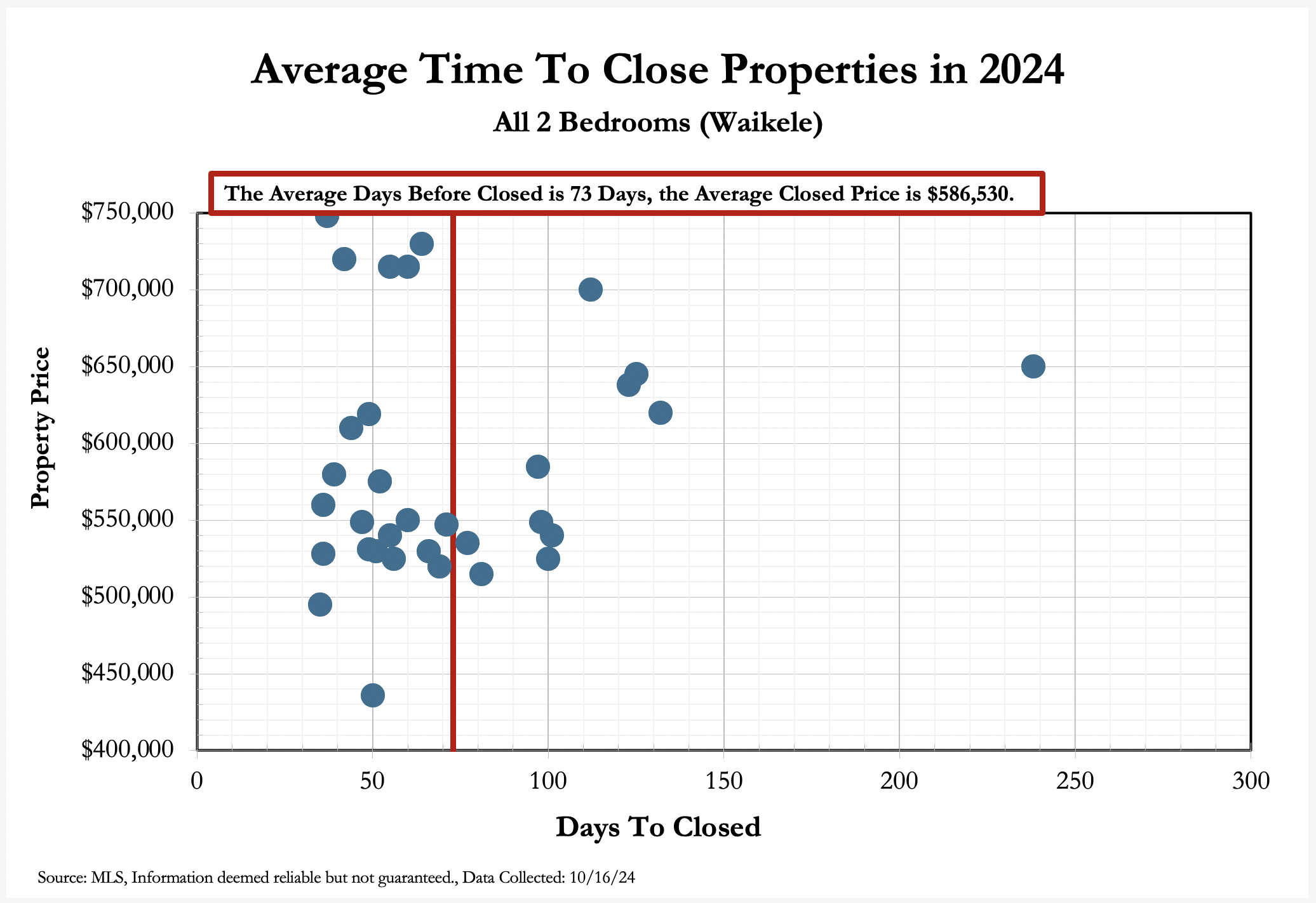

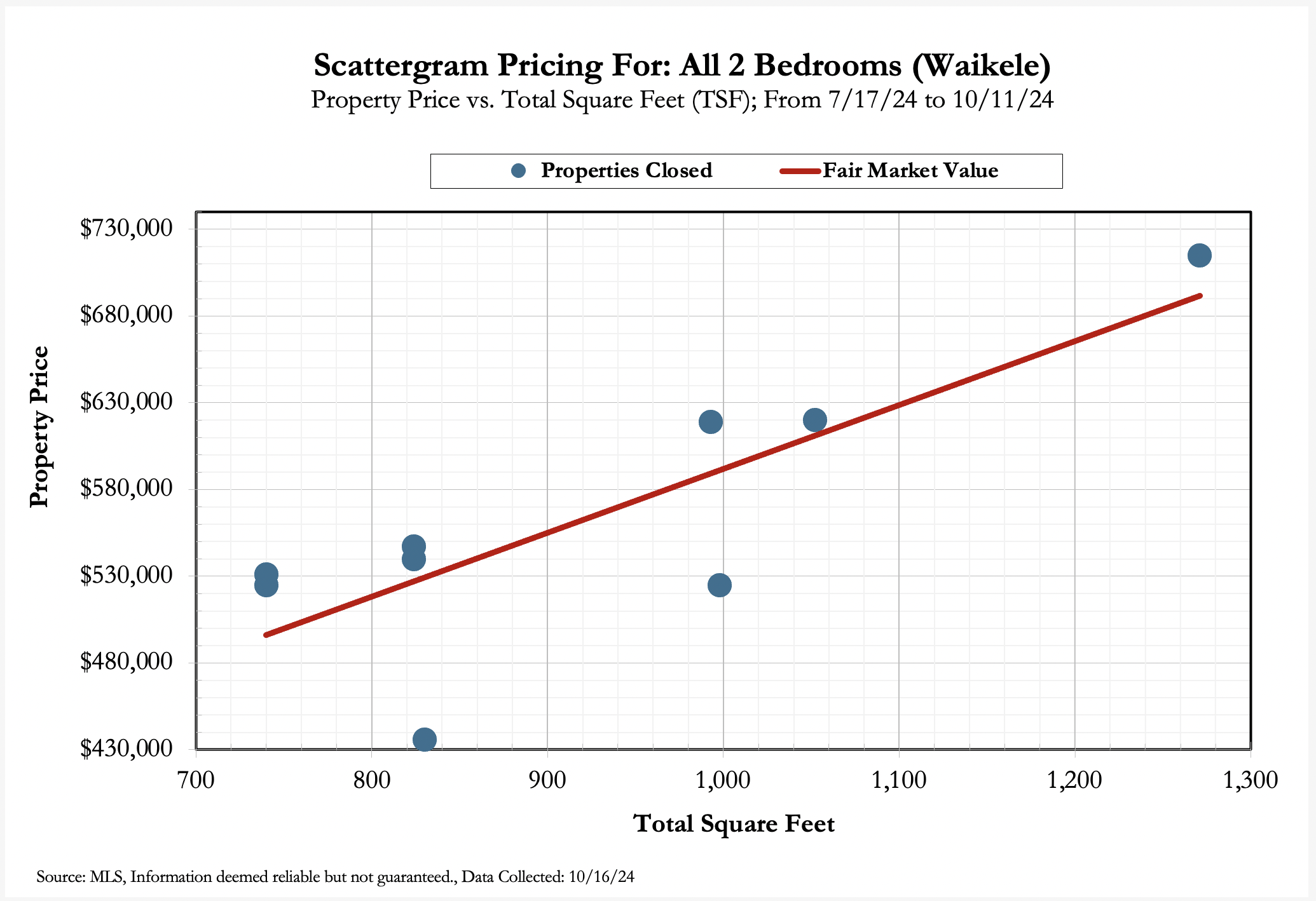

In 2023, it took an average of 69 days to close a 2-bedroom Waikele townhome for an average sales price of $564,380.

In 2024, it took 73 days to close a unit (6% longer) for an average price of $586,530 (up 4%)

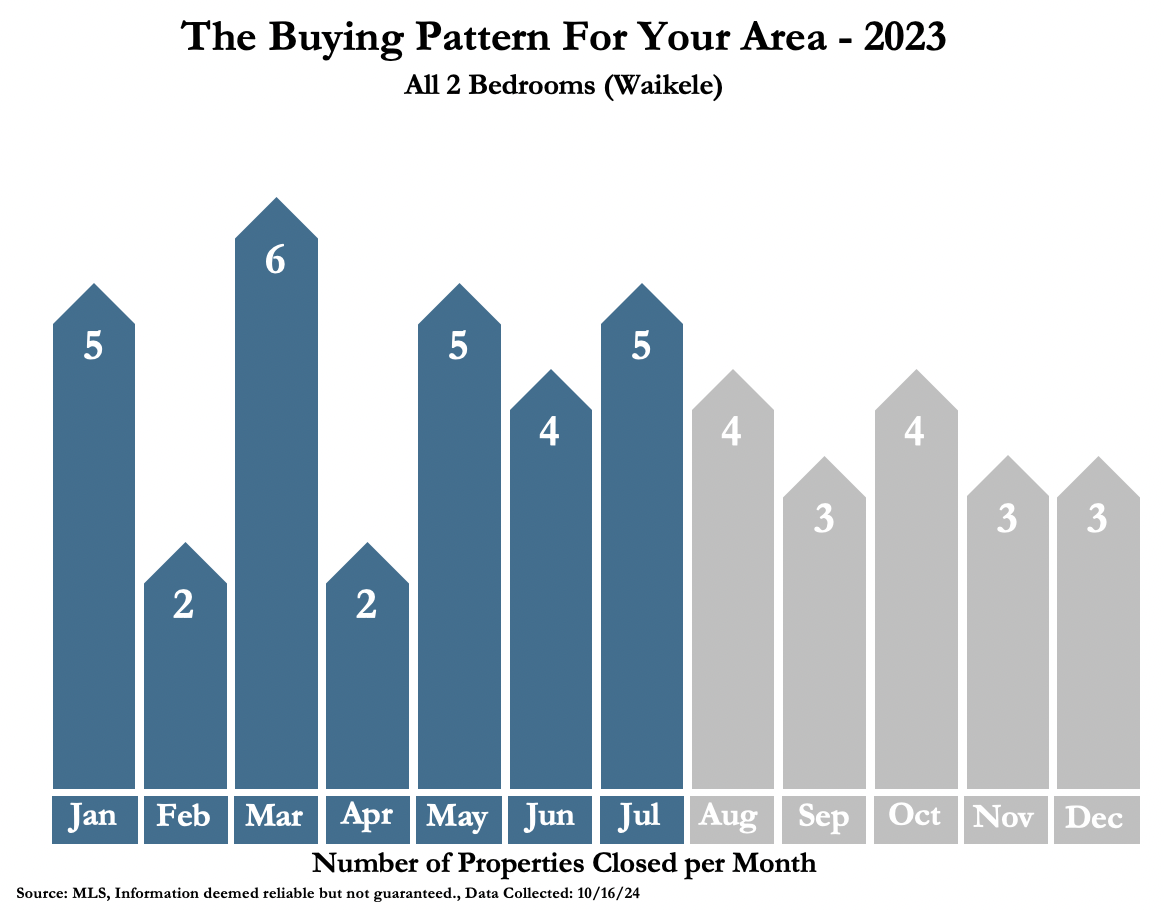

The Buying Patterns chart shows how the 46 closings of 2023 were dispersed throughout the year. In 2023, we saw the majority of activity in the 1st half (blue), but in actuality the distribution is fairly consistent throughout the year.

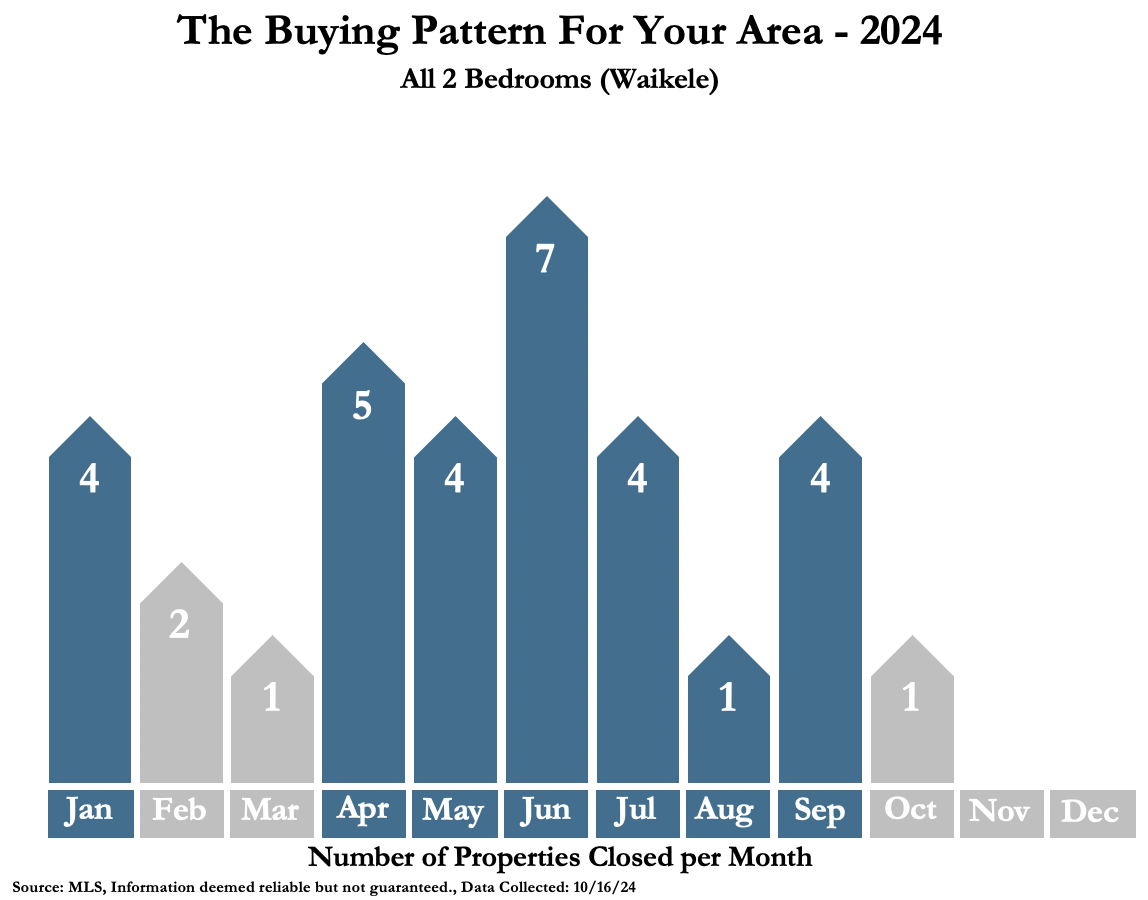

So far, in 2024, we have had 33 closings. These closings were again consistently distributed through out the year. This closing data is based upon the date in which the townhome closed. If we assume an average escrow of 30 to 45 days and that June had the most closings this year, then April and May would be the best months to sell property. There are currently 6 properties in escrow, so we may see several more closings before the end of the year.

This scattergram attempts to show us the relationship between square footage and price.

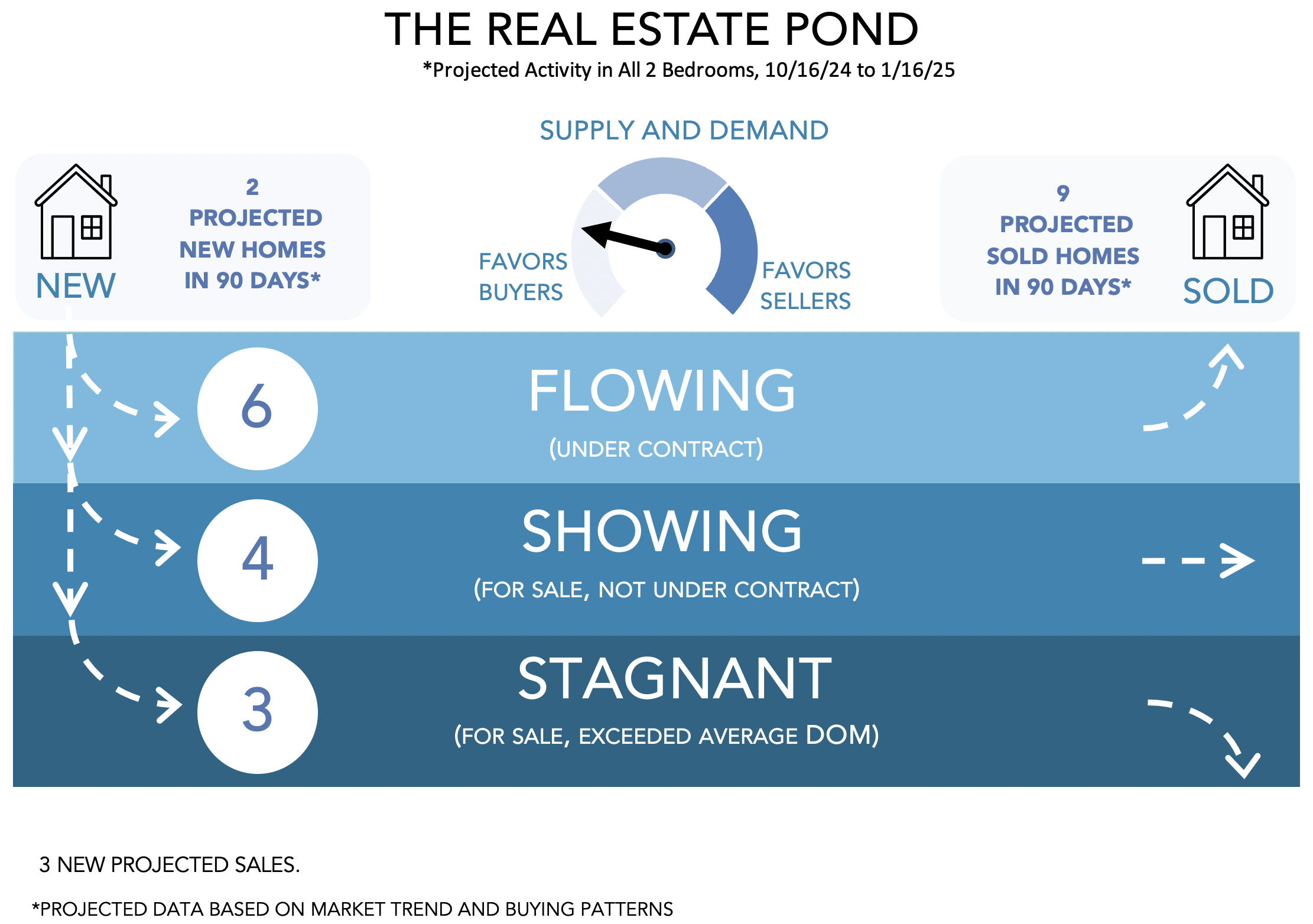

The pond analysis chart tries to take the past 2 years of data and try to predict the next 90 days. It is projected that 2 new townhomes will come on the market and there will be 9 closings. The pond tries to illustrate how properties come on the market to the left and hopefully “flow” across the pond, find a buyer and then exit the pond as a sale to the right. The 6 properties that are “flowing” are the current 6 escrows. Then deeper in the pond, where the water is not moving as quickly, are properties that are still for sale and have not found a buyer. These properties are either over priced, under marketed or perhaps difficult to see. Difficult to see properties can include tenant occupied listings. With a tenant, potential buyers need to give 48 hours notice to show, so showings are difficult